| ¨ | Fee paid previously with preliminary materials. | ||||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

Letter to Shareholders

As CEO, I am proud to be leading Nautilus Inc. through the most exciting time for our Company and in the fitness category since our founding in 1986. Over the last year, the world has been profoundly challenged, and our industry has seen an incredible evolution as our customers have adapted to the realities of the COVID-19 pandemic. We believe this has created a long-term fundamental shift in consumer behavior, which we believe will significantly enhance the home fitness market for years to come. The combination of long-term assets, progress we’ve made before and during the pandemic, and a recently launched transformative strategic direction has resulted in Nautilus being better positioned to be a leader in the home fitness category than any other time in our 35-year history. I could not be prouder of the team’s efforts, our results, and our long-term prospects.

Since I joined in the second half of 2019, our team has worked tirelessly to determine the right strategy needed to leverage our strengths and to build long-term relationships with our customers. Although 2020 was unique as the macro environment was challenged by the global pandemic, we fully capitalized on the opportunity as our customers pivoted towards at-home fitness. We accelerated our strategy with the launch of JRNY®, our new digital platform that elevates the fitness experience across all of our products. We created ambitious goals for 2020 that would lead us on the right path to prepare for our digital transformation, and I am proud of the considerable progress we have made over the past year.

2020 Goals Achieved

•Accelerate Connected Fitness through the Portfolio

◦We created an impressive roadmap and launched eight new connected fitness cardio products across three modalities, all with screens and JRNY® connectivity. This not only permits us to help more consumers reach their fitness goals on an ongoing long-term basis, but it also provides an important component of the installed base to more rapidly accelerate JRNY® membership growth.

•Find a Sustainable Model for Direct-to-Consumer

◦We evaluated our past direct-to-consumer strategy and activated a new plan to accelerate our return to profitable growth. This included pulling back on promotional spending and shifting our mindset to a “total media” approach, adding PR and social media strategies to more traditional paid media programs. As a result of our efforts, direct sales grew by 101% year-over-year.

•Drive Profitable Growth in Retail

◦We produced the best year ever in Retail with revenue growth of 95%, excluding sales related to the Octane brand, by strengthening partnerships with strategic accounts and onboarding new customers outside of the traditional sporting goods space. In the pandemic, more retailers began to carry fitness products, and we effectively managed supply and demand to develop and sustain long-term relationships.

•Strengthen the Balance Sheet

◦We secured $70 million in new debt financing and, combined with our strong financial performance, improved our ending cash position from $11 million to $94 million in 2020.

2020 Financial Highlights

Not only did the achievement of our 2020 goals enhance our digital transformation and prepare Nautilus for our new long-term strategy, but we also delivered tremendous performance for the year. Revenue grew 79% year-over-year, or 97% if we exclude sales related to the Octane brand. This growth was driven by strong demand for our strength and cardio products. We saw continued momentum in the connected-fitness bikes we introduced in late 2019, the Bowflex® C6 and Schwinn® IC4, and increased demand for the Bowflex® SelectTech® strength products. Importantly, we have seen a positive response to our new JRNY® powered Bowflex® connected-fitness products, including the award-winning VeloCore® bikes, new Treadmills, and new Max Trainers®. Further, our ability to balance outsized revenue growth with prudent cost management enabled us to deliver the highest level of operating income in 18 years.

“North Star Journey to 2026”: Our New Long-Term Strategy Unveiled

As part of our strategic evaluation, we made the decision to focus solely on home fitness, and therefore, sold our commercially focused Octane Fitness brand. We’ve also made focusing decisions relative to the role of each brand in our portfolio. In 2020, evolving the supply chain became mission critical and we worked to increase capacity of up to five times pre-pandemic levels to better meet elevated home fitness demand.

To continue the momentum we have achieved, we put in place a long-term strategy we call “North Star Journey to 2026.” This plan leverages our strengths of well-known brands, a broad portfolio of quality equipment and wide omnichannel distribution, while addressing the Company’s inherent weaknesses that the team and I diagnosed when I first arrived at Nautilus. This strategic direction was the result of a six-month process of analyzing data, forming insights, and ultimately committing to a sustainable plan that we are passionate about and expect will deliver value to our stakeholders over the long run. I hope you were able to attend our March 18, 2021, Investor Day roll-out of North Star. The webcast is still available in the investor relations section of our website. Here are the key elements of the strategy.

Five Strategic Pillars of Our North Star Strategy

1) Adopt a Consumer-First Mindset

◦We have restructured our approach to product development by gathering consumer input at the beginning of the process and testing marketing messages earlier in the development cycle to ensure our communications are driving an emotional connection with the consumer. We moved from a traditional product-led approach to a model focused on strength and cardio category management for Bowflex®, Schwinn® and JRNY®. We have better segmented our customers and are targeting new high-growth segments, including more displaced gym-goers. Moving forward, we will focus our product portfolio in the mid and premium tiers of each category.

2) Scale a Differentiated Digital Offering

◦A strong JRNY® platform will enable us to give our customers the best connected-fitness experience. Nautilus is delivering an amazing combination of high quality, innovative physical equipment with a digital platform that allows members to access a wide variety of hyper-personalized workouts. This includes coaching, immersive content and entertainment features at an incredible value. JRNY® creates a connected fitness experience, allowing end-users to both personalize how they want to work out and,

through artificial intelligence, ensuring that each workout is unique and motivationally challenging. JRNY® is a platform that crosses product modalities and we have plans to scale it through our current and future customer base, as well as through partnerships.

3) Focus Investments on Core Businesses

◦We will be more disciplined about investments across brands, consumer segments, products and geographies, making fewer, bigger and bolder bets. This includes plans to have a more focused and deliberate portfolio, where every product within each brand will have a clearly identified reason for being, all centered on what the customer wants. International growth will also be a large opportunity and we have identified countries we believe represent the best profit pools.

4) Evolve Supply Chain to Be a Strategic Advantage

◦We plan to continue our progress to bring capacity more in line with the levels of elevated demand. Over the long term, we will work to create geographic diversity to reduce risk and transport times. We recently recruited a world-class supply chain leader to build upon our progress and take our supply chain capabilities to the next level.

5) Build Organizational Capabilities to Win

◦The most important piece of Nautilus’ strategic plan is unleashing the power of our team. The profound change in our digital transformation must be carefully sequenced and managed. This transformation requires existing skills to be leveraged and new capabilities to be built. Our leaders are passionate about personal development and know that our people are the foundation for achieving our North Star plan. We have a new mission, vision and values, and we recently hired a new Chief People Officer to help us evolve our organizational capabilities and talent management.

While our path forward represents the next phase for our Company, we remain committed to our heritage of delivering innovative products using hundreds of patents in our portfolio. Our broad distribution and incredible network of retail partners, combined with our direct-to-consumer roots, gives our customers a seamless omni-channel experience. Our people work at Nautilus because they love our industry and are guided by our mission to help people lead healthier lives. Our brands continue to be strong with high consumer awareness and award-winning modalities. Nautilus stands for high quality and good value. These attributes create a strong base that will allow us to continue to build our connected fitness platform and drive significant growth over the long term.

The future is bright for the “new” Nautilus. We believe we are now better positioned than ever before to build a clear competitive advantage through new customers, deeper retail relationships, and a stronger financial profile. This is in addition to cementing a new leadership team that will execute on our North Star plan, digitally transform the business and unlock sustainable long-term growth and profitability. We will leverage our brands, products, innovation, distribution and digital assets to build a healthier world, one person at a time.

On behalf of all of us at Nautilus, I thank you for your continued support at the most exciting time in our Company’s long history.

Onwards and upwards,

Jim Barr

Chief Executive Officer

NAUTILUS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders of Nautilus, Inc.:

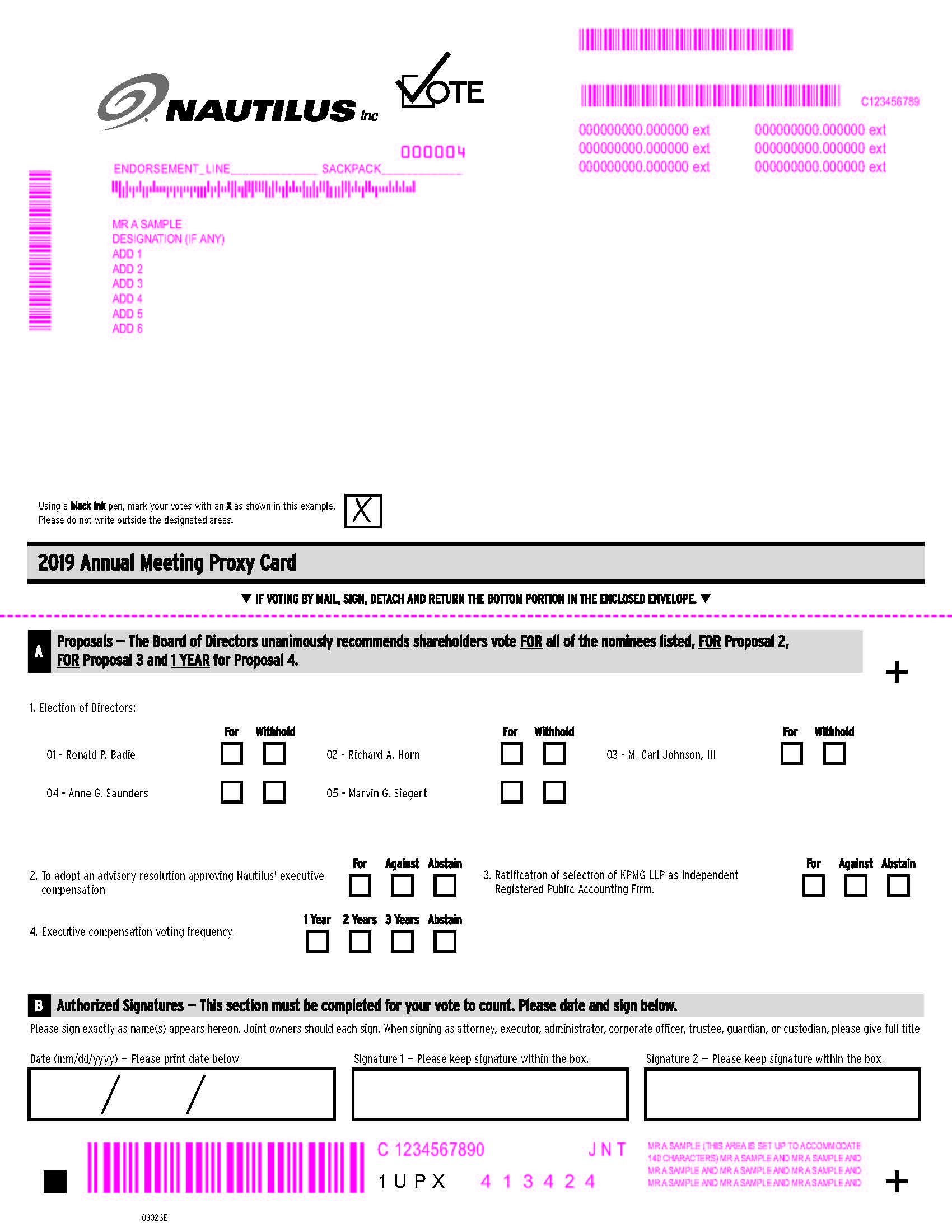

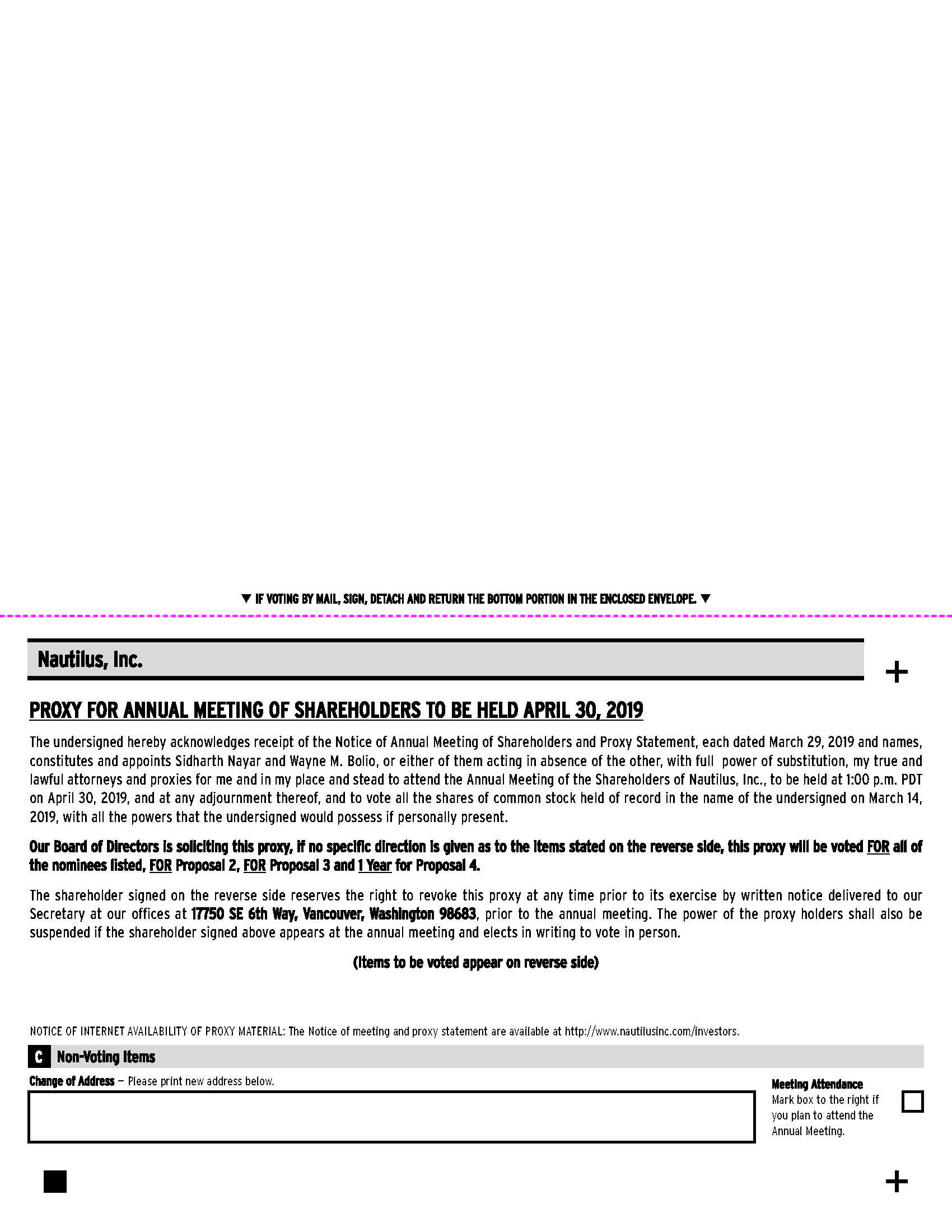

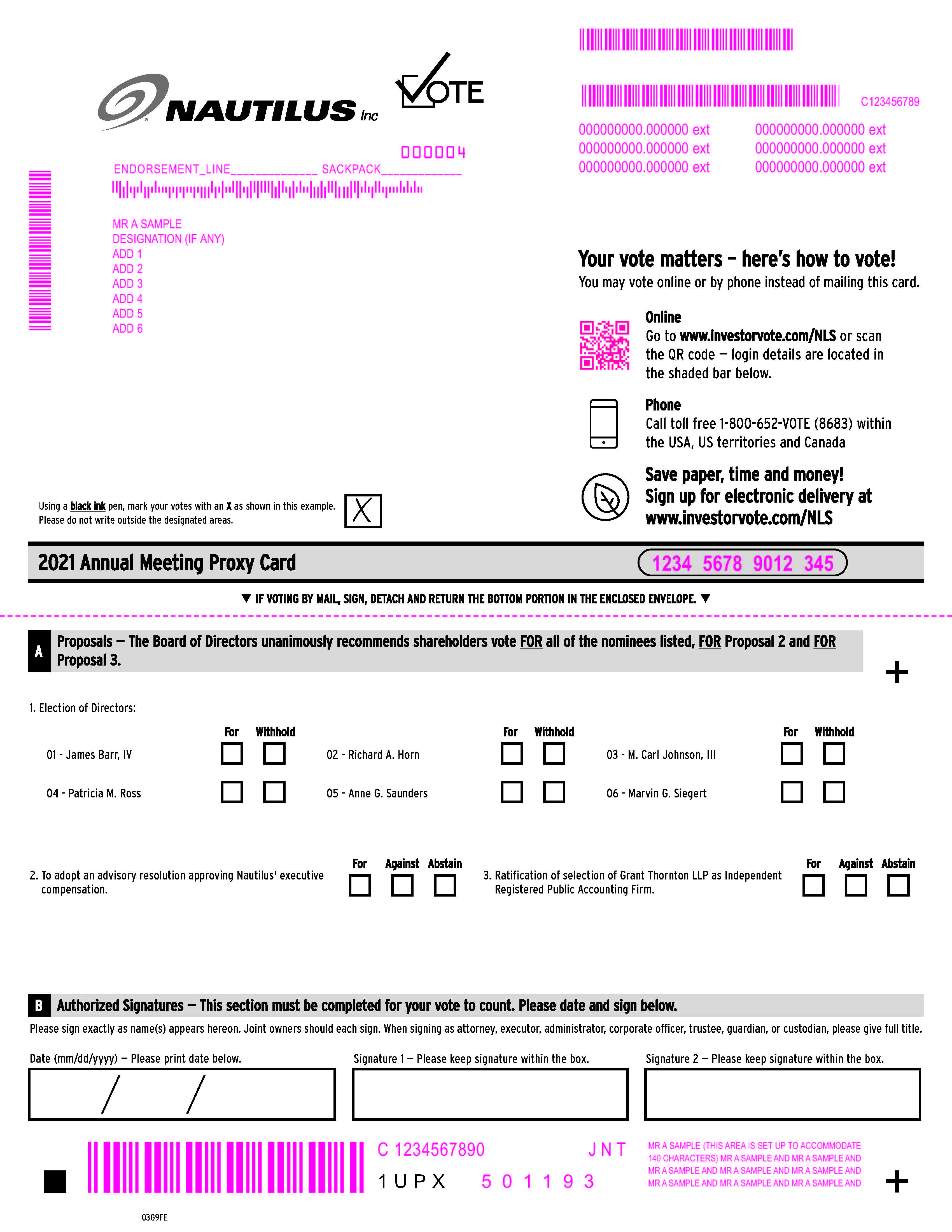

The annual meeting of shareholders of Nautilus, Inc. will be held on Tuesday, April 30, 2019, at our headquarters building, 17750 S.E. 6th Way, Vancouver, Washington 98683, beginningWednesday, June 16, 2021, at 1:00 p.m. Pacific Daylight Time,Time. With the health and well-being of our shareholders, employees, directors, auditors, and those corporate partners who normally attend the annual meeting in mind and to reduce costs and environmental impact, this year's annual meeting will be a completely virtual meeting and will be conducted via live webcast. You will not be able to attend the annual meeting in person. You will be able to participate in the annual meeting of shareholders online, vote and submit your questions during the meeting by visitingwww.meetingcenter.io/276664349, for the following purposes:

| 1. | To elect a Board of Directors, consisting of | ||||

| 2. | To approve the compensation of the named executive officers | ||||

| 3. | To ratify the Audit Committee's appointment of | ||||

| 4. | ||||

| To consider and act upon any other matter which may properly come before the annual meeting or any adjournment thereof. | |||

Only shareholders who held their shares at the close of business on March 14, 2019,April 16, 2021, the record date, are entitled to receive notice of and to vote at the annual meeting or any adjournment or postponement thereof.

All shareholders are cordially invited to attendparticipate in the annual meeting. Whether or not you plan to attendparticipate in the annual meeting, please sign and promptly return the enclosed proxy card, which you may revoke at any time prior to its use. A prepaid, self-addressed envelope is enclosed for your convenience. Your shares will be voted at the annual meeting in accordance with your proxy.

| By Order of the Board of Directors, | |||||

| /s/ Wayne M. Bolio | |||||

WAYNE M. BOLIO Secretary | |||||

Vancouver, Washington

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholders to Be Held On April 30, 2019:June 16, 2021:

Pursuant to rules promulgated by the Securities and Exchange Commission (the "SEC"“SEC”), we have elected to provide access to our proxy materials both by sending you this full set of proxy materials, including a Notice of Annual Meeting and a 20182020 Annual Report to Shareholders, and by notifying you of the availability of our proxy materials on the Internet. The Notice of Annual Meeting, Proxy Statement and 20182020 Annual Report to Shareholders are available at http://www.nautilusinc.com/investors.www.nautilusinc.com. In accordance with the SEC rules, the materials on the website are searchable, readable and printable, and the website does not have “cookies” or other tracking devices which identify visitors. Directions to our annual meeting are also available at http://www.nautilusinc.com/investors.

2021 ANNUAL MEETING OF SHAREHOLDERS

SHAREHOLDER

PROXY STATEMENT

TABLE OF CONTENTS

NAUTILUS, INC.

17750 S.E. 6th Way

Vancouver, Washington 98683

PROXY STATEMENT

General Information

Our Board of Directors (the “Board”) is furnishing this Proxy Statement and the accompanying Annual Report to Shareholders, Notice of Annual Meeting and proxy card in connection with its solicitation of proxies for use at our 20192021 annual meeting of shareholders (the “Annual Meeting”) or any adjournment thereof. The Annual Meeting will be held on Tuesday, April 30, 2019,Wednesday, June 16, 2021, beginning at 1:00 p.m., Pacific Daylight Time, online via live webcast at www.meetingcenter.io/276664349.The password for the following location:

Our Board has designated the two personsperson named on the enclosed proxy card, Sidharth Nayar and Wayne M. Bolio,Aina E. Konold, to serve as proxiesproxy in connection with the Annual Meeting. These proxy materials and the accompanying Annual Report to Shareholders are being mailed on or about MarchApril 29, 20192021 to our shareholders of record as of March 14, 2019.April 16, 2021.

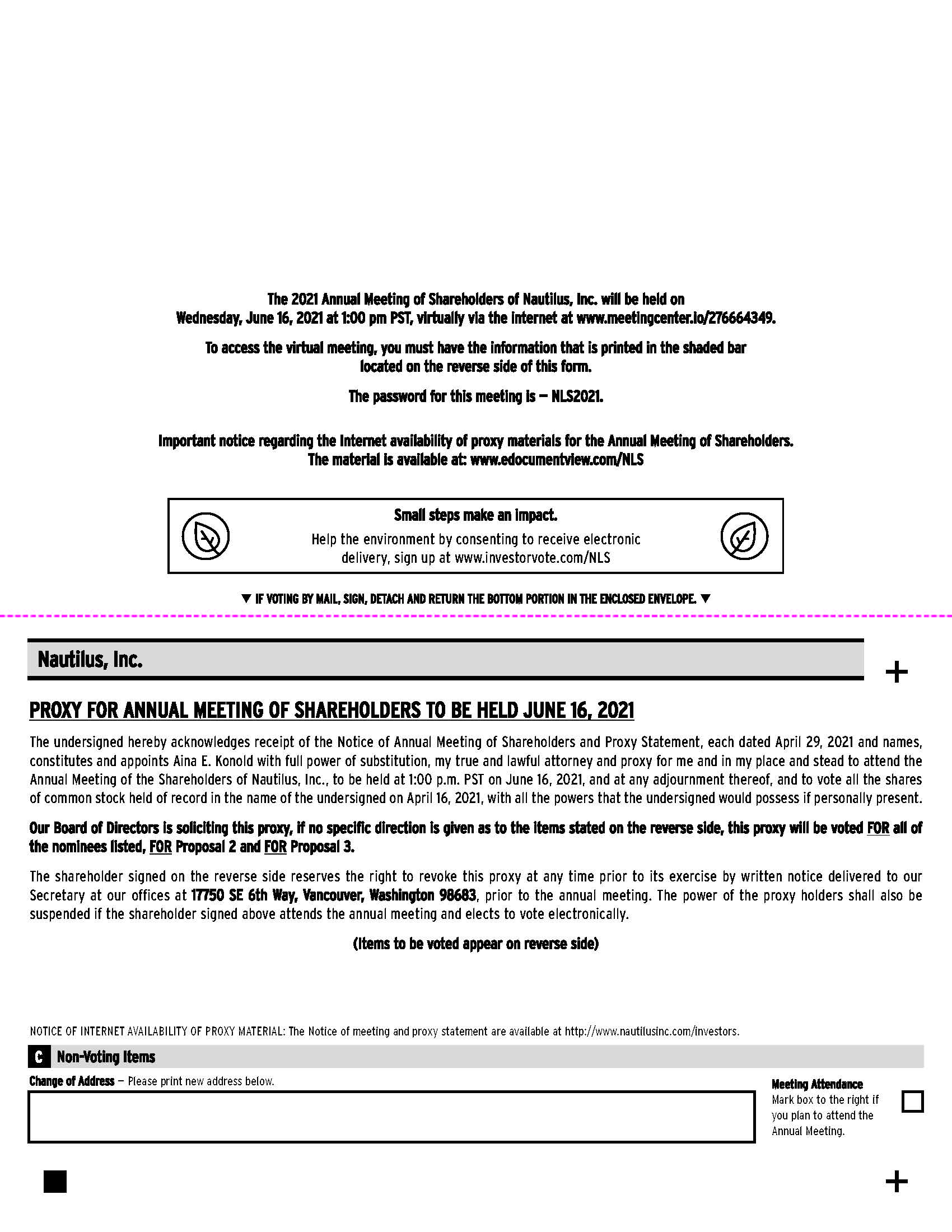

Participating in the Annual Meeting

We will be hosting the Annual Meeting live via Internet webcast. You will not be able to attend the meeting in person. A summary of the information you need to participate in the Annual Meeting online is provided below:

•Any shareholder may listen to the Annual Meeting and participate live via webcast at www.meetingcenter.io/276664349. The password for the meeting is NLS2021. The webcast will begin at 1:00 p.m. Pacific Daylight Time on Wednesday, June 16, 2021.

•Shareholders may vote and submit questions during the Annual Meeting via live webcast.

•To enter the meeting, please have your 15-digit control number which is available on your proxy card. If you do not have your 15-digit control number, you will be able to listen to the meeting only, you will not be able to vote or submit questions during the meeting.

•Instructions on how to connect to and participate in the Annual Meeting via the Internet, including how to demonstrate proof of stock ownership, are posted at www.meetingcenter.io/276664349.

How Do I Vote?

If you are a shareholder of record, there are several ways to vote:

•by participating in the Annual Meeting and voting according to the instructions posted at www.meetingcenter.io/276664349;

•by completing and mailing your proxy card (if you received printed proxy materials); or

•by following the instructions on your proxy card for voting either online or by phone.

Even if you plan to participate in the Annual Meeting, we recommend that you also vote by proxy so that your vote will be counted if you later decide not to participate in the Annual Meeting.

If you are a street name shareholder, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to instruct your broker, bank or other nominee on how to vote your shares. Street name shareholders should generally be able to vote by returning an instruction card, or by telephone or on the Internet. However, the availability of telephone and Internet voting will depend on the voting process of your broker, bank or other nominee. As discussed below, if you are a street name shareholder, you may not vote your shares live during the Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee

Can I attend the Annual Meeting in person?

With the health and well-being of our shareholders, employees, directors, auditors and those corporate partners who normally attend the annual meeting in mind, we will be hosting the Annual Meeting via live webcast on the Internet. You will not be able

1

to attend the Annual Meeting in person. The webcast will start at 1:00 p.m. Pacific Daylight Time, on June 16, 2021. Shareholders may vote and submit questions while connected to the Annual Meeting on the Internet. Any shareholder can listen to and participate in the Annual Meeting live via the Internet at www.meetingcenter.io/276664349. The password for the meeting is NLS2021.

What do I need in order to be able to participate in the Annual Meeting online?

You will need the 15-digit control number included on your proxy card in order to be able to vote your shares or submit questions during the meeting. Instructions on how to connect and participate in the Annual Meeting via the Internet, including how to demonstrate proof of stock ownership, are posted at www.meetingcenter.io/276664349. If you do not have your 15-digit control number, you will be able to listen to the meeting only, you will not be able to vote or submit questions during the meeting.

Revocability of Proxies

•delivering written notice of revocation to our Secretary;Secretary at the address provided on page 1 above; or

•delivering an executed proxy bearing a later date to our Secretary; orSecretary at the address provided on page 1 above.

If you are a street name shareholder, your broker, bank or other nominee can provide you with instructions on how to change your vote.

Record Date

Our Board has fixed the close of business on March 14, 2019April 16, 2021 as the record date for determining which of our shareholders are entitled to notice of and to vote at the Annual Meeting. At the close of business on the record date, 29,590,022 30,576,289 shares of our common stock were outstanding.

Voting; Quorum

Each share of common stock outstanding on the record date is entitled to one vote per share at the Annual Meeting. Shareholders are not entitled to cumulate their votes. The presence, in persononline at the virtual meeting or by proxy, of the holders of a majority of our outstanding shares of common stock is necessary to constitute a quorum at the Annual Meeting.

Votes Required to Approve Each Proposal

If a quorum is present at the annual meeting:Annual Meeting:

(i) the five (5)six (6) nominees for the election of directors who receive the greatest number of votes cast by the shares present and voting in persononline at the virtual meeting or by proxy will be elected as directors; and

(ii) the proposalsproposal regarding the advisory vote on named executive officer compensation will be approved if the number of votes cast in favor of the proposal exceeds the number of votes cast against it; and

(iii) the ratification of the selection of the independent registered public accounting firm will be approved if the number of votes cast in favor of the proposal exceeds the number of votes cast against it; andit.

Counting of Votes; Abstentions

You may vote “FOR” or “WITHHOLD” authority to vote for the nomineenominees for election as a director.directors. If you vote your shares without providing specific instructions, your shares will be voted FOR the nomineenominees for election to the Board of Directors. If you vote to “WITHHOLD” authority to vote for the nomineenominees for election as a director,directors, the shares represented will be counted as present for the purpose of determining a quorum, but they will not be counted as a vote cast on the proposal and will have no effect in determining whether thea nominee is elected.

2

You may vote “FOR” or “AGAINST” or “ABSTAIN” from voting when voting on the proposals regarding the advisory vote on named executive officer compensation and the ratification of the selection of the independent registered public accounting firm, and the advisory vote on the frequency of the vote on executive compensation.firm. If you choose “ABSTAIN” from voting on a proposal, your shares represented will be counted as present for the purpose of determining a quorum, but will not be counted as votes cast on the proposal and will have no effect in determining whether the proposal is approved.

Broker Discretionary Voting

If your shares are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in “street name,” and the Notice of Annual Meeting was forwarded to you by your broker or nominee, who is considered the shareholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares. Beneficial owners are also invited to participate in the Annual Meeting. However, since a beneficial owner is not the shareholder of record, you may not vote your shares of our common stock at the Annual Meeting unless you follow your broker’s procedures for obtaining a legal proxy. If you request a printed copy of our proxy materials by mail, your broker, bank or other nominee will provide a voting instruction form for you to use. Throughout this proxy statement, we refer to shareholders who hold their shares through a broker, bank or other nominee as “street name shareholders.”

If you hold your shares in street name, your broker, bank or other similar institution may be able to vote your shares without your instructions depending on whether the matter being voted on is “discretionary” or “non-discretionary.” In the case of a discretionary matter (for example, the ratification of the independent registered public accounting firm), your broker is permitted to vote your shares of common stock if you have not given voting instructions. In the case of a non-discretionary matter (for example, the election of directors and the advisory vote to approve named executive compensation and the advisory vote on the frequency of the vote on executiveofficer compensation), your broker cannot vote your shares if you have not given voting instructions.

A “broker non-vote” occurs when your broker submits a proxy for the Annual Meeting with respect to discretionary matters, but does not vote on non-discretionary matters because you did not provide voting instructions on these matters. Broker non-votes are counted for the purpose of determining the presence or absence of a quorum, but are not counted as votes cast for a proposal and will have no effect on the outcome of any proposal. Therefore, it is important that you provide specific voting instructions to your broker, bank or similar institution.

Proxy Procedure

When a proxy card is properly dated, executed and returned, the shares it represents will be voted at the Annual Meeting in accordance with the instructions specified in the proxy. If no specific instructions are given, the shares will be voted FOR the election of the director nominees described below, FOR the proposal to approve, on a non-binding, advisory basis, the compensation of our named executive officers as set forth in the proxy statement and FOR the ratification of KPMGGrant Thornton LLP as our independent registered public accounting firm for the transition period ended March 31, 2021 and fiscal year ending DecemberMarch 31, 2019, and to select ONE YEAR as the frequency for future advisory votes on executive compensation.2022. If other matters come before the Annual Meeting, the persons named in the accompanying proxy will vote in accordance with their best judgment with respect to such matters.

Cost of Proxy Solicitation

We will bear all costs associated with the solicitation of proxies in connection with the annual meeting.Annual Meeting. We do not plan to hire a proxy solicitor, but, to the extent we choose to use proxy solicitor services, we will pay the related fees and expenses.

Procedures for Shareholder Proposals and Nominations

Under our amended and restated bylaws, as amended ("Bylaws"(“Bylaws”), nominations for directors at an annual meeting may be made only by (1) the Board or a committee of the Board, or (2) a shareholder entitled to vote who has delivered notice to us within 120 to 180 days before the first anniversary of the date of the mailing of the notice for the preceding year's annual meeting.

Our Bylaws also provide that business may not be brought before an annual meeting unless it is: (1) specified in the notice of meeting (which includes shareholder proposals that we are required to include in our proxy statement under SEC Rule 14a-8); (2) brought before the meeting by or at the direction of the Board; or (3) brought by a shareholder entitled to vote who has delivered notice to us (containing certain information specified in the Bylaws) withinnot less than 120 toor more than 180 days before the first anniversary of the date of the mailing of the notice for the preceding year's annual meeting. In addition, you must

3

comply with SEC Rule 14a-8 to have your proposal included in our proxy statement. A copy of the full text of our Bylaws may be obtained upon written request to our Secretary at the address provided on page 1 of this Proxy Statement.

To be timely for our 2022 annual meeting, we must receive the written notice at our principal executive offices not earlier than October 29, 2021 and not later than the close of business on December 29, 2021.

In the event that we hold our 2022 annual meeting more than 30 days before or more than 60 days after the one-year anniversary of the Annual Meeting, notice of a shareholder proposal that is intended to be included in our proxy statement for the 2022 annual meeting must be received no earlier than the close of business on the 120th day before our 2022 annual meeting of shareholders and no later than the close of business on the later of the following two dates:

•the 90th day prior to our 2022 annual meeting; or

•the 10th day following the day on which public announcement of the date of our 2022 annual meeting is first made.

Where can I find the results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we will file a Current Report on Form 8-K to publish preliminary results and will provide the final results in an amendment to the Current Report on Form 8-K after they become available.

Where You Can Find More Information

We file our proxy statements and other information with the SEC under the Securities Exchange Act of 1934, as amended (“Exchange Act”). You can inspect and obtain a copy of our proxy statement and other information filed with the SEC at the offices of the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549, on official business days during the hours of 10 a.m. to 3 p.m. EST. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. The SEC maintains an Internet site at http://www.sec.gov/ where you can obtain most of our SEC filings. We also make available, free of charge, on our website at www.nautilusinc.com, ourwww.nautilusinc.com/investors, our proxy statements filed with the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after they are filed electronically with the SEC.

4

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

According to our Bylaws, our Board shall be comprised of nonot less than five (5) nor more than fifteen (15) directors, provided, however that the number may be otherwise set by resolution of our Board. The Board has fixed the authorized number of our directors at five (5)six (6).

At this Annual Meeting, our shareholders will elect a board consisting of five (5)six (6) directors to serve until our 20192022 annual meeting or until their respective successors are elected and qualified. Our Board has nominated the individuals listed below to serve on our Board. All of the nominees are currently members of our Board. If any nominee is unable or unwilling to serve as a director at the time of the Annual Meeting, our Board may provide for a lesser number of directors or designate a substitute. If our Board designates a substitute, the proxy holders will have the discretionary authority to vote for the substitute. Proxies may not be voted for more than five (5)six (6) nominees.

OUR BOARD UNANIMOUSLY RECOMMENDS YOU VOTE "FOR"“FOR” EACH OF THE FOLLOWING NOMINEES FOR ELECTION AS DIRECTOR:

James “Jim” Barr, IV, 58, joined Nautilus, Inc. as Chief Executive Officer and Board Member in July 2019. He brings with him key capabilities of driving growth through people leadership, consumer-driven marketing, innovation and technology, as well as multiple successes transforming and growing large scale digital and multichannel businesses in diverse industries. Before joining Nautilus, Inc. Mr. Barr was Group President of Ritchie Bros., a global leader in the sales of used industrial equipment. Prior to that Mr. Barr held the position of EVP and Chief Digital Officer of OfficeMax where he led the transformation of its online and omnichannel experiences. In 2008, Mr. Barr was named the first President of Sears Holdings’ newly-formed Online Business Unit, where he developed and drove an omnichannel and online strategy that rapidly expanded the product assortment and growth. Mr. Barr’s foundational digital experiences came as an executive for 12 years in Microsoft’s online businesses as GM, Commerce Services, where he led Microsoft’s B2C ecommerce businesses, such as online shopping, classified advertising and auctions, as well as underlying technology platforms, and, before that was GM, MSN Business Development. Mr. Barr holds a B.S. from Miami University, and an M.B.A. in Finance from the University of Chicago Booth School of Business.

M. Carl Johnson, III, 70, became interim Chief Executive Officer of Nautilus on March 2, 2019. Mr. Johnson 72,joined our Boardboard in July 2010 and has been Chairman of ourthe Board of Directors of Nautilus, Inc. since 2011.2011 and served as interim Chief Executive Officer from February 2019 – July 2019. Mr. Johnson is a member of the Compensation Committee. He joined the Board of Directors of CHW Acquisition Corporation in March 2021. He joined the Board of Directors of Vespa Parent LLC (owner of Nonni’s Food Group) in October, 2018. In October 2015, Mr. Johnson retired as Executive Vice President, Marketing and Chief Growth Officer of Big Heart Pet Brands, a division of J.M. Smucker Company. In this role he had line and operating responsibility for the company’s widely distributed brands, and the innovation, marketing and creative services, consumer and customer insights, communications and government relations groups, and the company’s Canadian subsidiary. He joined Del Monte Foods, a privately-owned manufacturer and marketer of processed foods, and the predecessor of Big Heart Pet Brands, in November 2011 as Executive Vice President, Brands. From 2001 until April 2011, Mr. Johnson served as Senior Vice President and Chief Strategy Officer of the Campbell Soup Company, a producer of canned soups and related products, where he had direct responsibility for corporate strategy, research and development, quality, corporate marketing services, licensing, and e-business. Mr. Johnson joined Campbell from Kraft Foods, where he ran three successively larger business divisions. Earlier in his career, he held management positions at Colgate-Palmolive and Polaroid Corporation and served as head of the Consumer Goods consulting practice at Marketing Corporation of America. Mr. Johnson completed a 2016 Fellowship at Harvard University’s Advanced Leadership Initiative and a 2017 Fellowship at Stanford University’s Distinguished Careers Institute. Mr. Johnson serves as an executive committee member of the Agricultural Sustainability Institute, University of California, Davis. Mr. Johnson is a trustee of the Adelphic Educational Fund, Wesleyan University, which grants scholarships and supports educational, literary and artistic programs. He is also a member of the Steering Committee of the Kilts Center for Marketing at the University of Chicago Graduate School of Business, which provides scholarships to top marketing students and helps the school steer its marketing curriculum. Mr. Johnson is also a member of the Nutrition Round Table, Harvard T.H. Chan School of Public Health, Harvard University. Mr. Johnson earned his B.A. degree in Government and Economics from Wesleyan University, and his M.B.A. degree from the University of Chicago. Our Board has determined that Mr. Johnson has the requisite experience and expertise to be a director of Nautilus based on his consumer marketing expertise and strong background in corporate expansion strategy.

Richard A. Horn, 71, 74,joined our Board in December 2007 was elected to our Board in December 2007. Mr. Horn is the Chairman of the Compensation Committee and is a member of the Audit Committee and the Nominating and Corporate Governance Committee. Mr. Horn has been a private investor since February 2002. Mr. Horn was general manager of the

5

PetsHotel Division of PetSmart, Inc., a company that provides products, services and solutions for the lifetime needs of pets, from April 2001 through February 2002. From January 1999 through March 2001, he was Senior Vice President and General Merchandise Manager of PetSmart.com, Inc. and from July 1994 until December 1998, he was Vice President and General Merchandise Manager of PetSmart, Inc. From 1992 to 1994, Mr. Horn was Chief Financial Officer of Weisheimer Companies, Inc., a chain of retail pet supply stores. Mr. Horn was a partner at Coopers & Lybrand (now

PricewaterhouseCoopers), an international public accounting and business consulting firm, from 1980 to 1992. Mr. Horn serves as Chairman ofon the Board of Trustees of Saint Joseph’s Hospital and Medical Center and Saint Joseph’s Westgate Hospital in Phoenix, Arizona. He is also on the Board of Directors of the Fiesta Bowl and serveswhere he served as its Treasurer. Mr. Horn graduated from Indiana University, Bloomington, with a B.S. in Accounting. Our Board has determined that Mr. Horn has the requisite experience and expertise to be a director of Nautilus. As a former retail merchandising and direct-marketing executive, former Chief Financial Officer and a former partner at Coopers & Lybrand, Mr. Horn brings particular expertise to our Board in the areas of direct marketing sales, consumer product merchandising and retail trade, service industries, investor relations, financial reporting, accounting and auditing for complex multinational operations.

Patricia “Patty” M. Ross, 56, currently serves as Founder and Principal of PMR Consulting, LLC, a management consulting company, since March 2017. Ms. Ross joined the Board in March 2020 and currently serves as a member of the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee. She is an accomplished Senior Executive who leverages her experience, leadership acuity, and definitive record, positioning her as a go-to global strategist in the consumer product industry. Ms. Ross most recently served Apple as an Executive Advisor for the People organization, where she delivered talent management, retention, inclusion, and diversity strategies across all US and global divisions since November 2019 (NASDAQ: AAPL). From 1992 to March 2017, Ms. Ross spent her career with Nike (NYSE: NKE), where she dedicated over 34 years in strategy, process re-engineering, operations, and general management roles. Including GM, Asia Pacific Equipment; Senior Director, Global Footwear; VP, Global Product Process Innovation, and finally a VP in Global Operations, Innovation & Technology. She is routinely trusted and relied upon to start up new divisions, functional units, and incubators, charged with implementing change, innovation, and growth. Her direct efforts led to millions of revenue dollars for Nike annually. In addition to her professional contributions at Nike, Ms. Ross gained a reputation for both innovative excellence and reliable execution by spearheading value initiatives such as the first e-commerce B2B website for retailers, Nike’s Product Creation Center of Excellence, Nike’s Workplace of the Future, and the Women of Nike Diversity Network. Ms. Ross holds a Bachelor of Applied Science degree in Marketing and Finance from Portland State University, a coaching certification in Executive Leadership Development from The Hudson Institute of Coaching, and an Advanced Management certificate in Business Administration and General Management from Harvard Business School. She is also a graduate of the Executive Education Program at Harvard Business School, where she focused on corporate boards, governance, operations, and management. In addition to growing and reshaping organizations as a strategic advisor and operations leader, Patty is also active in various professional boards and speaking engagements. Ms. Ross serves as a Board Member for MMC Corp, a provider of preconstruction and constructive services, since January 2020, and an Advisor to ThenWhat, Inc., a brand strategy and content creation agency, since February 2020, and Caterpillar, Inc. (NYSE: CAT), a manufacturer of construction and mining equipment, since March 2014. She is also an active member of the National Association of Corporate Boards (NACD), Athena Alliance, WomenExecs on Boards, and Women Corporate Directors (WCD), and the International Coaching Federation (ICD) where she is committed to the professional development of executives of all ages. Our Board has determined that Ms. Ross has the requisite experience to be a director of Nautilus. Ms. Ross brings to our Board a strong background in consumer products, corporate governance, talent development, and operations expertise to Nautilus.

Anne G. Saunders, 57,59, joined our Board in April 2012. Ms. Saunders is the Chairman of the Nominating and Corporate Governance Committee and a member of the Audit Committee and the Compensation Committee. Since November 2017, Ms. Saunders has been a non-executive director of the Ten PeaksSwiss Water Process Decaffeinated Coffee Company (TSX:TPK)SWP), a global leader in natural process green coffee decaffeination, where she isChairs the Corporate Governance and of Compensation Committee. Since March 2019, Ms. Saunders has also served as a member ofnon-executive director for The WD-40 Company a global consumer products company with an icon brand. She Chairs the Compensation Committee.Committee, and also serves on the Nominating/Governance and Audit Committees. From April 2016 to January 2017, Ms. Saunders was U.S. President of NakedWines.com, a global wine company that uses crowdfunding to fund independent wine makers and direct ships wine to customers. From September 2014 to April 2016, Ms. Saunders was U.S. President of FTD, Inc. (NYSE:FTD), a global floral and gifting company. From August 2012 to January 2014, Ms. Saunders was President of Redbox, an entertainment company that is owned and operated by Coinstar, Inc. (NASDAQ:CSTR). From March 2009 until January 2012, Ms. Saunders was Executive Vice President and Chief Marketing Officer for Knowledge Universe, a privately-held early education company with over 1,600 schools nationwide. From February 2008 until March 2009, Ms. Saunders was Senior Vice President, Consumer Bank Executive and, from May 2007 until February 2008, she was Senior Vice President, Brand Executive, for Bank of America Corporation (NYSE:BAC). Between 2001 and 2007, Ms. Saunders held a variety of positions with Starbucks Coffee Co. (NASDAQ:SBUX), including Senior Vice President, Global Brand, during that company’s period of rapid domestic and international growth. Ms. Saunders has also held executive and senior management positions with eSociety, a B2B e-commerce

6

company, AT&T Wireless and Young & Rubicam. Additionally, Ms. Saunders served, from 2006 until 2007, as a director for Blue Nile, Inc. (NASDAQ:NILE). She received a B.A. from Northwestern University and an M.B.A. from Fordham University. Our Board has determined that Ms. Saunders has the requisite experience to be a director of Nautilus. Ms. Saunders brings to our Board a strong background in marketing and building brands and provides Nautilus with additional expertise and understanding of the consumer marketplacemarketplace.

Marvin G. Siegert, 70,72, joined our Board in August 2005. Mr. Siegert is Chairman of the Audit Committee and a member of the Compensation Committee and the Nominating and Corporate Governance Committee. Currently aMr. Siegert is currently retired but remains active by serving on company boards and pursuing private investor,investments. From July of 2007 to September 2009 Mr. Siegert was Presidentemployed by Hat World, Inc and Chief Operating OfficerImpact Sports, distributors of team apparel. Prior to that he was President of The Pyle Group, LLC, a private equity investment group, from December 1996 untilto July of 2007. Prior to The Pyle Group, Mr. Siegert spent 26 years withpreviously worked at Rayovac Corporation, a manufacturer of batteries and lighting products, where he held various positions, withproducts. An employee from 1970 to December 1996, his most recent position aswas Senior Vice President and Chief Financial Officer. From 2010 until February 2018, Mr. Siegert served as Audit Committee Chairmanearned his Bachelor’s degree in Accounting from U.W. Whitewater in 1970 and a Master’s degree in Management from U.W. Madison in 1976. He completed an eight-week program at MIT for Senior Executives during the spring of 1993. Mr. Siegert received U.W. Whitewater’s Beta Alpha Psi Outstanding Alumnus Award in 1987. He was also inducted into U.W. Whitewater’s School of Business Hall of Fame in 1994. Mr. Siegert currently serves on the Board of Directors of Great Lakes Educational Loan Services, Inc., a privately-held student loan servicing company. He is also a member of the Board of Directors offollowing Boards: Uniek, Inc., Nautilus,Inc. and NorthStar Education Services ,LLC. He is a manufacturer and distributor of picture frames and wall décor. From 2005 until December 2012, Mr. Siegert was apast member of both the BoardUniversity of Directors of Hy Cite Corporation, a privately-held direct sales marketing company. In addition, from January 2014 until December 2016, Mr. SiegertWisconsin Madison Foundation and the the U.W.-Whitewater Foundation. He previously served on the Board of Directors offor Greenwoods State Bank,The Pyle Group LLC, Rayovac Corporation, Hy Cite Corporation, Behrens Manufacturing, Acquisition,Inc., a manufacturerGreat Lakes Educational Loan Services,Inc. and distributor of high quality metal containers.Georgette Klinger, Inc. Mr. Siegert graduated fromis also a past member of the UniversityNakoma Golf Club Board,Edgewood High School’s Board of Wisconsin, Whitewater with a degreeTrustees, Edgewood’s Athletic Board, National Association of Accountants, Planning Executives Institute, In Business Advisory Board, and West Metropolitan Business Association. He is an avid supporter of the U.W. Madison Athletic Program including membership in accountingthe Mendota Gridiron Club and holds a Master’s degree in management from the University of Wisconsin, Madison. The Overtime Club. Our Board has determined that Mr. Siegert has the requisite experience and expertise to be a director of Nautilus. As a former President and Chief Operating Officer of a private equity investment group and former Chief Financial Officer of a privately-held global consumer products company, Mr. Siegert brings a particular expertise to our Board in the areas of consumer products, investor relations and financial strategies.

No family relationship exists among any of the directors or executive officers. No arrangement or understanding exists between any director or executive officer and any other person pursuant to which any director was selected as a director or executive officer of Nautilus.

7

INFORMATION CONCERNING THE BOARD OF DIRECTORS

Our Board oversees our overall performance on behalf of our shareholders. Members of our Board stay informed of our business through discussions with our Chief Executive Officer ("CEO"(“CEO”) and other members of our executive team, by reviewing materials provided to them, and by participating in regularly scheduled Board and committee meetings.

Corporate Governance

Our Board is elected by our shareholders to govern our business and affairs. Our Board selects our senior management team, which is charged with conducting our business. Having selected our senior management team, our Board acts as an advisor to senior management and monitors their performance. Our Board reviews strategies, financial objectives and operating plans. It also plans for management succession of our CEO, as well as other senior management positions, and oversees our compliance efforts. Throughout the COVID-19 pandemic we transitioned our workforce to remote work environment and at our distribution centers added safety measures and protocols were added to enhance the wellness of our employees.

Our Board has determined that each of Ronald P. Badie, Richard A. Horn, M. Carl Johnson, III, Patricia M. Ross, Anne G. Saunders and Marvin G. Siegert qualify as an “independent director” under our Corporate Governance GuidelinesPolicies (available on our website at www.nautilusinc.com), Section 303A.02 of the Listed Company Manual (the "Listed“Listed Company Manual"Manual”) of the New York Stock Exchange ("NYSE"(“NYSE”), and applicable rules of the SEC, and that each such person is free of any relationship that would interfere with the individual exercise of independent judgment. Our Board has further determined that each member of the Board's three committees meets the independence requirements applicable to those committees prescribed by the Listed Company Manual and the SEC, including Rules 10A-3(b)(1) and 10C-1 under the Exchange Act related to independence of audit committee and compensation committee members, respectively.

Our Board met eleveneight times in 20182020 and all of our directors attended at least 75% of the meetings of our Board and of the meetings held by the committee(s) on which they served. Currently, we do not have a policy requiring our Board members' attendance at the annual shareholders meeting. All of our directors attended our 20182020 annual shareholders meeting.

In order to promote open discussion among independent directors, our Board has a policy of conducting executive sessions of independent directors during each regularly scheduled board meeting and at such other times if requested by an independent director. These executive sessions are generally led by our Chairman.

Transactions with Related Persons

Our Board recognizes that “transactions” with a “related person” (as such terms are defined in Item 404 of Regulation S-K) present a heightened risk of conflict of interest and/or improper valuation (or the perception thereof) and, therefore, has adopted a policy which shall be followed in connection with all related person transactions. Specifically, this policy addresses our procedures for the review, approval and ratification of all related person transactions.

Our Board has determined that the Audit Committee is best suited to review and approve related person transactions. Accordingly, any related person transactions recommended by management shall be presented to the Audit Committee for approval at a regularly scheduled meeting of the Audit Committee. Any related person transaction shall be consummated or shall continue only if the Audit Committee approves the transaction, the disinterested members of our Board approve the transaction, or the transaction involves compensation approved by the Compensation Committee.

Committees of the Board

Our Board currently has three standing committees: an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. Each committee is governed by a written charter that may be amended by our Board at any time. The full text of each committee charter our Code of Business Conduct and Ethics and our Corporate Governance GuidelinesPolicies are available on our website located at www.nautilusinc.com or in printwww.nautilusinc.com. In addition, we will promptly deliver free of charge, upon request, a copy of the committee charters, Code of Business Conduct and Ethics and our Corporate Governance Policies to any interested party who requests it.shareholder requesting a copy. Requests should be sent to the Nautilus, Inc. Secretary at the address provided on page 1 of this Proxy Statement.

The Audit Committee

The Audit Committee is established in accordance with Section 3(a)(58)(A) of the Exchange Act and represents and assists our Board in fulfilling its oversight responsibility relating to (i) the integrity of our financial statements and other financial information furnished by Nautilus, (ii) our compliance with legal and regulatory requirements, (iii) our system of internal accounting and

8

controls over financial controls,reporting, (iv) our independent registered public accounting firm's qualifications, performance, compensation and independence, (v) the performance of our internal audit function, and (vi) compliance with our code of business conduct and ethics.

In fulfilling the duties outlined in its charter, the Audit Committee, among other things, shall:

•have the sole authority and responsibility to select, evaluate and, where appropriate, replace our independent registered public accounting firm;

•review and discuss with management and our independent registered public accounting firm, prior to release to the general public and legal and regulatory agencies, our annual audited financial statements and quarterly financial statements, including disclosures contained in our Annual Report on Form 10-K under the section heading “Management's Discussion and Analysis of Financial Condition and Results of Operations,” and matters required to be reviewed under applicable legal, regulatory or public company exchange listing requirements;

•discuss polices developed by management and our Board with respect to risk assessment and risk management and steps management has taken to monitor and control financial risk exposure, including anti-fraud programs and controls;

•review the responsibilities, functions and performance of our internal audit function, including internal audit's charter, plans and budget and the scope and results of internal audits;

•review management's report on internal control over financial reporting and discuss with management and the independent registered public accounting firm any significant deficiencies or material weaknesses in the design or operation of our internal controls; and

•establish procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters, including procedures for the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters or violations of our code of conduct.

During 2018,2020, the Audit Committee consisted of fourfive independent directors: Marvin G. Siegert (Chairman), Richard A. Horn, Patricia M. Ross and Anne G. Saunders and Mr. Ronald P. Badie Richard A. Horn and Anne G. Saunders.was a member until his retirement on May 1, 2020. Ms. Ross was appointed to the Audit Committee in March 2020. Each member of the Audit Committee meets the independence, financial literacy and experience requirements contained in the corporate governance listing standards of the NYSE relating to audit committees. In addition, our Board has determined that Messrs. Badie, Horn and Siegert each qualify as an “audit committee financial expert” under the regulations of the SEC. Although all members of the Audit Committee meet the current NYSE regulatory requirements for accounting or related financial management expertise, and our Board has determined that Messrs. Badie, Horn and Siegert each qualify as an “audit committee financial expert,” members of the Audit Committee are not professionally engaged in the practice of auditing or accounting and are not technical experts in auditing or accounting. The Audit Committee met four times during 2018.2020.

A copy of the full text of the Audit Committee Charter can be found on our website at www.nautilusinc.com.

The Compensation Committee

The Compensation Committee is responsible for overseeing the compensation of our employees, including equity-based plans, and employee benefit plans and practices, including the compensation and benefits of our executive officers. The Compensation Committee also administers our Amended and Restated 2015 Long-Term Incentive Plan.Plan (the "2015 LTIP").

In fulfilling the duties outlined in its charter, the Compensation Committee, among other things, shall:

•periodically review our executive and director compensation plans in light of our goals and objectives with respect to such plans and, if the committee deems appropriate, adopt, or recommend to our Board the adoption of new, or the amendment of existing, executive compensation plans;

•annually evaluate the performance of our CEO and, with our CEO's participation and input, that of our other executive officers in light of the goals and objectives of our executive compensation plans. Based on this evaluation, the Compensation Committee shall determine and approve the CEO's compensation level and, with the CEO's participation and input, the compensation levels of our other executive officers;

•approve any equity compensation awarded to any of our executive officers, subject to the requirements of the applicable compensation plans; and

•with respect to SEC reporting requirements, review and discuss with management our compensation discussion and analysis, and oversee the preparation of, and approve, the Compensation Committee's report on executive compensation to be included in our proxy statement.

The Compensation Committee may not delegate any power or authority required by any law, regulation or listing standard to be exercised by the committee. The Compensation Committee met threesix times during 2018.2020. Pursuant to its charter, the Compensation Committee has the authority, to the extent it deems necessary or appropriate, to retain compensation consultants,

9

independent legal counsel or other advisors and has the sole authority to approve the fees and other retention terms with respect to such advisors. From time to time the Compensation Committee has engaged compensation consultants to advise it on certain matters. See "Compensation“Compensation Discussion and Analysis."”

A copy of the full text of the Compensation Committee Charter can be found on our website at www.nautilusinc.com.

Compensation Committee Interlocks and Insider Participation

During 2018,2020, the Compensation Committee was comprised of five independentsix independent directors: Richard A. Horn (Chairman), Ronald P. Badie, M. Carl Johnson III, Patricia M. Ross, Anne G. Saunders, and Marvin G. Siegert. Mr. Johnson resigned as a member ofSiegert and Ronald P. Badie. Ms. Ross was appointed to the Compensation Committee in connection withMarch 2020. Mr. Badie was a member until his appointment as interim Chief Executive Officerretirement on March 2, 2019.May 1, 2020. None of the members of the Compensation Committee have a relationship with Nautilus, other than as directors and shareholders. NoWith the exception of Mr. Johnson's interim service, no member of the Compensation Committee is, or was formerly, an officer or an employee of Nautilus. None of our executive officers served, during the year ended December 31, 2018,2020, as a member of the compensation committee or on the board of directors of any entity that has an executive officer serving as a member of our Compensation Committee or Board.

The Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for considering and making recommendations concerning the membership and function of the Board, and the development and review of corporate governance guidelines.

In fulfilling the duties outlined in its charter, the Nominating and Corporate Governance Committee, among other things, shall:

•identify individuals qualified to become members of our Board and select director nominees to be presented for shareholder approval at our annual meeting of shareholders;

•review our Board's committee structure and recommend to the Board for its approval directors to serve as members of each committee;

•develop and recommend to our Board for its approval a set of corporate governance guidelines;

•develop and recommend to our Board for its approval an annual self-evaluation process of the Board and its committees; and

•review, on an annual basis, director compensation and benefits.

The Nominating and Corporate Governance Committee will consider recommendations for directorships submitted by shareholders. Shareholders who wish the Nominating and Corporate Governance Committee to consider their directorship recommendations should submit their recommendations in writing to Nautilus, Inc., 17750 S.E. 6th Way, Vancouver, Washington 98683, Attn: ChairmanChairwoman of Nominating and Corporate Governance Committee. Recommendations by shareholders that are made in accordance with these procedures will receive the same consideration given to nominations made by the Nominating and Corporate Governance Committee.

Nominees may be suggested by directors, members of management, shareholders or, in some cases, by a third-party firm. In identifying and considering candidates for nomination to the Board, the Nominating and Corporate Governance Committee considers a candidate's quality of experience, our needs and the range of talent and experience represented on our Board. In evaluating particular candidates, the Nominating and Corporate Governance Committee will review the nominee's personal and professional integrity, judgment, experience, and ability to serve the long-term interest of the shareholders. The Nominating and Corporate Governance Committee will also take into account the ability of a director to devote the time and effort necessary to fulfill his or her responsibilities, as well as matters of diversity, including gender, race and national origin, education, professional experience and differences in viewpoints and skills. While the Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity, both the Board and the Nominating and Corporate Governance Committee believe that it is essential that Board members represent a diverse range of experience, expertise and viewpoints.

During 2018,2020, the Nominating and Corporate Governance Committee was comprised of fourup to five independent directors: Anne G. Saunders (Chairman)(Chairwoman), Richard A. Horn, Patricia M. Ross and Marvin G. Siegert. Mr. Ronald P. Badie Richard A. Horn, and Marvin G. Siegert.was a member until his retirement on May 1, 2020. The Nominating and Corporate Governance Committee met two timefour times during 2018.2020.

A full copy of the Nominating and Corporate Governance Committee Charter can be found on our website at www.nautilusinc.com.

Communications with Directors

All interested parties may send correspondence to our Board or to any individual director at the following address: Nautilus, Inc., 17750 S.E. 6th Way, Vancouver, Washington 98683.

10

Your communications should indicate that you are a shareholder of Nautilus. Depending on the subject matter, we will either forward the communication to the director or directors to whom it is addressed (or, if no director is specified, to the Chairman), attempt to handle the inquiry directly, or not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic. Correspondence marked confidential will not be opened prior to forwarding to the Board or any individual director.

Board Leadership Structure

Our Board has a majority of independent directors; fourfive out of the fiveour six director nominees are independent. The Audit, Compensation, and Nominating and Corporate Governance committees each are composed solely of independent directors.

We separate the roles of Chairman of the Board and CEO in recognition of the differences between the two positions. Mr. Johnson, who acts as the Chairman, oversees our business broadly, leads the meetings of our Board, and provides guidance to our management. Our CEO is generally charged with oversight of the day-to-day operations of the business. We believe that consistency between day-to-day operations and the overall management is reached through the service of our CEO as a director, but the separation of the Chairman and CEO roles is important to achieve a balance of oversight that is favorable to us and our shareholders. Although Mr. Johnson is currently serving as our interim CEO, we anticipate reinstating this structure upon the engagement of a permanent CEO.

Board Role in Risk Oversight

While risk management is primarily the responsibility of our management team, our Board is responsible for overall supervision of risk management efforts as they relate to the key business risks we face. Management identifies, assesses, and manages the risks most critical to our operations and routinely advises our Board regarding those matters. Areas of material risk may include operational, financial, legal and regulatory, human capital, information technology and security, and strategic and reputational risks. Our Board's role in risk oversight is consistent with our leadership structure, with senior management having responsibility for assessing and managing risk exposure, and our Board and its committees providing oversight in connection with those efforts.

CORPORATE RESPONSIBILITY

At Nautilus, we are committed to a positive company culture that attracts and retains talent, engages with employees, and promotes wellness, while ensuring diversity, equity, and inclusion, for all employees.

Company culture

Aligning employees with North Star, our long-term strategic plan is critical to our success. As part of this launch, we created a new mission, vision, and set of values which were rolled out to all employees. We maintain and enhance our culture by conducting employee town halls, Final Fridays, Fireside Chats and other opportunities for open dialogue between the leadership team and employees. Our values that include caring deeply about our employees, partners, shareholders, and communities and we are committed to building a healthier world, one person at a time. We win together as a team and celebrate whenever possible. Our employee-led Culture Club, creates activities throughout the year that are focused on bringing together team members together to connect and celebrate. Through Nautilus Cares, employees have the opportunity to give back to the community, through such programs as Holiday Helper, Meals on Wheels, and other initiatives. These actions have resulted in us being identified as a Top Workplaces in the Oregon and SW Washington area for the last eight years. In addition, annualized voluntary turnover in 2020 was less than half the prior year.

Employee engagement and wellness

We place a large emphasis on employee engagement. Each year we conduct an employee engagement survey. The results and responses are reviewed, and initiatives are created to address areas of opportunities. This has included enhancements to internal communication, employee benefits and department processes. We believe in encouraging a healthy lifestyle for our customers and our employees. We foster a culture which supports all levels of wellness and offer a Road to Wellness passport program to help employees achieve their goals. In addition, we have a free on-site fitness center for employees and immediate family, discounts on fitness equipment, and the opportunity to participate in many company-sponsored fitness and community events throughout the year. Our employee-led Wellness Committee provides activities for all fitness levels. At the start of the COVID-19 pandemic, we transitioned our office workforce to remote work and added safety measures at all of our distribution center locations to protect our essential employees.

11

Diversity, Equity and Inclusion

We have been increasing our focus on diversity, equity, and inclusion through a series of key initiatives. Beginning in late 2019, we, added three women to our executive team. We also created an employee DEI committee to help guide the Company building and implementing plans that further our efforts to grow a diverse, equitable, and inclusive workforce. The Company introduced a floating paid day off to allow employees to volunteer with an organization or cause. We also added June 19th, “Juneteenth” as a company holiday. Other actions include a significant investment to a local organization that works to inspire and prepare underrepresented students to pursue science, technology, engineering, and math (STEM) majors in college and graduate school. While we are pleased with the progress we have made around these critical issues, we are committed to playing a larger role going forward.

12

DIRECTOR COMPENSATION

Nautilus has a Director Compensation Program that provides for compensation of the non-employee members of our Board. Director compensation consists of annual retainers, meeting fees, fees for service as a committee chair, and awards of equity compensation. Directors who are employees receive no additional or special remuneration for serving as directors.

Annual Retainer, Committee Chair and Meeting Fees

Under the Director Compensation Program, each non-employee director receives an annual retainer of $42,500 and a fee of $1,500 for attendance at each Board meeting. Our Board's Chairman receives an additional annual fee of $30,000, which will continue to be paid during Mr. Johnson's service as interim Chief Executive Officer.$30,000. Each director serving on a committee of our Board receives an additional fee of $1,500 for attendance at each committee meeting. The Chair of the Audit Committee receives an additional annual retainer of $10,000, while the Chairs of the Compensation Committee and the Nominating and Corporate Governance Committee each receive an additional annual retainer of $5,000. We also reimburse non-employee director expenses for attending meetings of the board of directors.

Initial Equity Grant

Annual Equity Grant

| 2018 Director Compensation | ||||||||||||

| Fees Earned or Paid in Cash | Stock Awards (1) | Total | ||||||||||

Ronald P. Badie | $ | 69,504 | $ | 58,512 | $ | 128,016 | ||||||

| Richard A. Horn | 74,504 | 58,512 | 133,016 | |||||||||

M. Carl Johnson, III (2) | 90,504 | 58,512 | 149,016 | |||||||||

| Anne G. Saunders | 74,504 | 58,512 | 133,016 | |||||||||

| Marvin G. Siegert | 79,504 | 58,512 | 138,016 | |||||||||

| 2020 Director Compensation | |||||||||||||||||||||||

| Fees Earned or Paid in Cash | Stock Awards (1) | Total | |||||||||||||||||||||

| Richard A. Horn | $ | 80,504 | $ | 115,934 | $ | 196,438 | |||||||||||||||||

| M. Carl Johnson, III | 96,504 | 115,934 | 212,438 | ||||||||||||||||||||

| Patricia M. Ross | 55,878 | 115,934 | 171,812 | ||||||||||||||||||||

| Anne G. Saunders | 80,504 | 115,934 | 196,438 | ||||||||||||||||||||

| Marvin G. Siegert | 85,504 | 115,934 | 201,438 | ||||||||||||||||||||

Ronald P. Badie (2) | 29,168 | — | 29,168 | ||||||||||||||||||||

(1)Stock award amounts reflect the aggregate grant date fair value of awards granted during | ||

(2)Ronald P. Badie's term as a director ended on his retirement May 1, 2020. | ||

| Equity Awards Outstanding at December 31, 2020 | ||||||||||||||

Unvested Stock Awards (# of Shares) (1) | Option Awards (# of Shares) (2) | |||||||||||||

| Patricia M. Ross | 17,460 | 15,000 | ||||||||||||

| Richard A. Horn | 17,460 | — | ||||||||||||

| M. Carl Johnson, III | 17,460 | — | ||||||||||||

| Anne G. Saunders | 17,460 | — | ||||||||||||

| Marvin G. Siegert | 17,460 | — | ||||||||||||

(1) | ||

(2) Stock options vested on March 9, 2021. | ||

13

| Equity Awards Outstanding at December 31, 2018 | ||||||

| Unvested Stock Awards (# of Shares) | Option Awards (# of Shares) | |||||

| Ronald P. Badie | 3,994 | — | ||||

| Richard A. Horn | 3,994 | 10,000 | ||||

| M. Carl Johnson, III | 3,994 | 10,000 | ||||

| Anne G. Saunders | 3,994 | 12,500 | ||||

| Marvin G. Siegert | 3,994 | — | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table summarizes certain information regarding the beneficial ownership of our outstanding common stock, as of March 1, 2019,31, 2021, by: 1) each director; 2) each of the named executive officers included in the Summary Compensation Table; 3) all persons that we know are beneficial owners of 5% or more of our common stock; stock as of the record date; and 4) all directors and executive officers as a group. Except as otherwise indicated, and subject to applicable community property laws, each owner has sole voting and sole investment powers with respect to all shares beneficially owned.

| Name of Beneficial Owner | Total Shares Beneficially Owned (2) | Percentage Beneficially Owned (3) | ||||||||||||

Granahan Investment Management, Inc. (4) | 3,597,568 | 11.8 | % | |||||||||||

BlackRock, Inc. (5) | 2,179,024 | 7.1 | % | |||||||||||

Dimensional Fund Advisors LP (6) | 1,722,888 | 5.6 | % | |||||||||||

The Vanguard Group (7) | 1,516,091 | 5.0 | % | |||||||||||

Non-Employee Directors (1) | ||||||||||||||

M. Carl Johnson, III (2) & (8) | 138,262 | * | ||||||||||||

Richard A. Horn (2) | 79,077 | * | ||||||||||||

Marvin G. Siegert (2) | 64,077 | * | ||||||||||||

Anne G. Saunders (2) | 38,077 | * | ||||||||||||

Patricia M. Ross (2) & (9) | 32,460 | * | ||||||||||||

Named Executive Officers (1) | ||||||||||||||

| James Barr, IV | 283,417 | * | ||||||||||||

| Aina E. Konold | 94,668 | * | ||||||||||||

| Christopher K. Quatrochi | 43,636 | * | ||||||||||||

| Wayne M. Bolio | 32,068 | * | ||||||||||||

| Becky L. Alseth | 11,621 | * | ||||||||||||

All Directors and Executive Officers as a Group (14 persons) | 1,060,181 | 3.5 | % | |||||||||||

| Name and Address of Beneficial Owner | Total Shares Beneficially Owned (2) | Percentage Beneficially Owned (3) | ||||

BlackRock, Inc.(4) | 4,471,941 | 15.1 | % | |||

| 55 E. 52nd Street | ||||||

| New York, NY 10055 | ||||||

Dimensional Fund Advisors, LP(5) | 2,045,802 | 6.9 | % | |||

| Building One | ||||||

| 6300 Bee Cave Road | ||||||

| Austin, TX 78746 | ||||||

Cooke & Bieler LP(6) | 1,922,540 | 6.5 | % | |||

| 1700 Market Street, Ste 3222 | ||||||

| Philadelphia, PA 19103 | ||||||

The Vanguard Group(7) | 1,910,665 | 6.5 | % | |||

| 100 Vanguard Blvd. | ||||||

| Malvern, PA 19355 | ||||||

LSV Asset Management(8) | 1,487,986 | 5.0 | % | |||

| 155 N. Wacker Drive, Ste 4600 | ||||||

| Chicago, IL 60606 | ||||||

Non-Employee Directors (1) | ||||||

| Richard A. Horn | 60,620 | * | ||||

| Marvin G. Siegert | 65,620 | * | ||||

| Ronald P. Badie | 64,820 | * | ||||

M. Carl Johnson, III(9) | 52,770 | * | ||||

| Anne G. Saunders | 23,620 | * | ||||

Employee Director (1) | ||||||

Bruce M. Cazenave (10) | 437,791 | 1.5 | % | |||

Named Executive Officers (1) | ||||||

| William B. McMahon | 155,030 | * | ||||

| Wayne M. Bolio | 74,136 | * | ||||

| Sidharth Nayar | 28,464 | * | ||||

| Christopher K. Quatrochi | — | * | ||||

| All Directors and Executive Officers as a Group (13 persons) | 965,412 | 3.2 | % | |||

* Less than 1%

(1) The address for each director and executive officer is c/o Nautilus, Inc., 17750 S.E. 6th Way, Vancouver, Washington 98683.

(2) Includes currently exercisable options, options17,460 shares issuable pursuant to stock awards that vest within 60 days of March 1, 2019, as follows:31, 2021.

(3) Percentages have been calculated based on 29,590,02230,576,289 shares of our common stock issued and outstanding as of March 1, 2019.31, 2021. Shares which the person or group has the right to acquire within 60 days after March 1, 201931, 2021 are deemed to be outstanding in calculating the percentage ownership of the person or group, but are not deemed to be outstanding as to any other person or group.

(4)Information is based on the Schedule 13G filed on January 31, 2019April 7, 2021 by BlackRock,Granahan Investment Management, Inc. (“BlackRock”Granahan”), a parent holding company. BlackRockan investment adviser. Granahan has sole dispositive power with respect to all shares reported and sole voting power with respect to 4,411,3943,597,568 shares. The address of the foregoing entity is 404 Wyman Street, Suite 460, Waltham, MA 02451.

(5)Information is based on the Schedule 13G filed on February 2, 2021 by BlackRock, Inc., a parent holding company. BlackRock Inc. has sole dispositive power and sole voting power with respect to all shares reported. The address of the foregoing entity is 55 East 52nd Street, New York, NY 10055.

(6) Information is based on Schedule 13G filed on February 12, 2021 by Dimensional Fund Advisors LP (“Dimensional”), an investment adviser. Dimensional has sole dispositive power with respect to all shares and sole voting power with respect to 1,722,888 shares. The address of the foregoing entity is Building One, 6300 Bee Cave Road, Austin, TX 78746.

(7) Information is based on Schedule 13G filed on February 8, 201910, 2021 by Dimensional Fund Advisors, LP ("Dimensional Fund"The Vanguard Group (“Vanguard”), an investment adviser. Dimensional FundVanguard has soleshared dispositive power, with respect to all shares reported and sole voting power with respect to 1,933,097 shares.

(8) Information is based on the Schedule 13G filed on February 13, 2019 by LSV Asset Management (“LSV”), an investment adviser. LSV has sole dispositive power with respect to all shares reported and sole voting power with respect to 786,061 shares.

14

EXECUTIVE OFFICERS

The following table identifies our executive officers as of the date of this Proxy Statement, the positions they hold and the year in which they began serving as officers of Nautilus. Our Board appoints all of our executive officers, who hold office until their respective successors are elected and qualified.

| Name | Age | Current Position(s) with Nautilus | Officer Since | |||||||||||||||||

| James Barr, IV | 58 | Chief Executive Officer | 2019 | |||||||||||||||||

| Aina E. Konold | 52 | Chief Financial Officer | 2019 | |||||||||||||||||

| Garry R. Wiseman | 44 | Senior Vice President and Chief Digital Officer | 2020 | |||||||||||||||||

| Becky L. Alseth | 59 | Chief Marketing Officer | 2020 | |||||||||||||||||

| Ellen Raim | 63 | Chief People Officer | 2021 | |||||||||||||||||

| John R. Goelz | 50 | Chief Supply Chain Officer | 2021 | |||||||||||||||||

| Christopher K. Quatrochi | 52 | Senior Vice President, Innovation | 2018 | |||||||||||||||||

Wayne M. Bolio (1) | 64 | Senior Vice President, General Counsel | 2003 | |||||||||||||||||

| Jay E. McGregor | 65 | Vice President, General Manager, Retail North America | 2018 | |||||||||||||||||

| Jeffery L. Collins | 54 | Vice President, General Manager, International | 2014 | |||||||||||||||||

| Name | Age | Current Position(s) with Nautilus | Officer Since | |||

| M. Carl Johnson III | 70 | Interim Chief Executive Officer | 2019 | |||

| Sidharth Nayar | 58 | Chief Financial Officer | 2014 | |||

| Wayne M. Bolio | 62 | Senior Vice President, Law and Human Resources, General Counsel | 2003 | |||

| Christopher K. Quatrochi | 50 | Senior Vice President, Innovation | 2018 | |||

| Jeffery L. Collins | 52 | Vice President, General Manager, International | 2014 | |||

| Ryan M. Simat | 42 | Vice President, General Manager, Commercial and Specialty | 2017 | |||

| Jay E. McGregor | 62 | Vice President, General Manager, North American Retail | 2018 | |||

| Carlos Navarro | 53 | Vice President, General Manager, Direct | 2019 | |||

(1) Mr. Bolio will be retiring in May 2021. | ||

Following are the biographies of the foregoing persons, except the biography of Mr. Barr, which is located above under the heading “Proposal No. 1: Election of Directors.”